KNL

Agriculture

Problem solving

- Collateral for a loan with real estate, land or agricultural machinery

- The need for immediate sale of grain at unprofitable prices immediately after harvest to receive finances in the spring and autumn periods

New opportunities

- Use of grain stocks as collateral for assets received

- Conclusion of a transaction for the tokenization of assets without the need to provide reporting documentation on the annual profitability of the enterprise

Conditions of receipt

- Standard financial model: repayment of the loan amount and interest on the loan

- Grain reserves or other crops are accepted as a pledge to attract investments from the agricultural producer

Real estate

Problem solving

- Failure to complete construction due to interruptions in funding

- The need to conclude loan contracts with high interest rates to obtain financing

New opportunities

- Receiving investments for the implementation of innovative projects in the construction industry

- Attracting investments for the construction of the project with favorable conditions for the return of loan funds

Conditions of receipt

- Application for the investment platform KNL

- The pledged projects are implemented projects from the developer/current project for which investments are requested

Oil industry

Problem solving

- Reduced funding for seismic surveys

- Financial support of companies specializing in the oil industry only from the state

New opportunities

- Attraction of assets from investors of the platform KNL

- Receipt of funds using a credit model for the implementation of research, exploration drilling

Conditions of receipt

- Creating a new application to attract investment on the platform

- As a mortgage loan investment, an oil producing company provides raw material - previously extracted oil

Fintech

Problem solving

- Closing implementations fintech startups due to lack of funding

- Poor or inadequate implementation of new ideas/startups in FINTECH industry using Blockchain technology

New opportunities

- Receiving funds to attract qualified personnel

- Attracting investments for the qualitative development of the idea and its implementation: from monetization to the technical development of the MVP startup

Conditions of receipt

- Application creation is available for registered users of KNL

- To receive investments, you need to mark up a startup with a detailed description and advantages in your personal account on the KNL platform

Other industries

Problem solving

- Lack of financing for the development and implementation of new projects in other areas

- The need to attract investment for the development of innovative industries: robotics, artificial intelligence and others

New opportunities

- Attracting private equity in other industries

- Receiving working capital for introducing innovations into existing projects, as well as development in new industries, increasing profitability

Conditions of receipt

- You need to create a new order on the platform KNL

- The user can create an application to raise capital in any other industry that is not represented on the KNL platform

MARKET ANALYSIS

For the last 20 years, the global market volume of agricultural exchange commodities has increased threefold:

from 570 billion dollars in 2000 to 1.6 trillion dollars in 2016, according to the UN. The average annual growth rate was

somewhere about 6%, however, after the crisis of 2008–2009, it fell significantly, as in other exchange goods markets

(such as oil, minerals, etc.). The distinctive feature of the agricultural products market is that its growth depends more

on the population needs’ growth that on the investors’ behavior.

According to data for 2016, the biggest importers of agricultural products worldwide, are the European Union

(39%), the USA (10%) and China (8%), which in 2000 had an only 6th place with 2.3%. When it comes exports, the

European Union is still a leader (41%); followed by the United States (11%), Brazil and China. Russia occupies the 16th

position in the world (1.1%).

The biggest contribution to the world market growth is made by developing countries. Because of the fact that

they have a rapid growth of per capita income, the result of it is an increase in demand for food. This way, in India in the

period from 2000 to 2015 revenuesincreasedmore than twofold, and in China - up to four times.

Despite the rapid market growth, agricultural products’ trade is related to several serious issues that are

worsened by current climate change.

Market analysis

The presented programs are basically aimed at reimbursing the already incurred costs and lowering

the loan debt burden of the enterprise, but they actually don’t solve the major problem of farmers, which is a

provision of easy accessto the loanable funds.

Taking into account that the existing methods of floating funds’ replenishing for agricultural holders

are frequently either oppressive or can’t be put into practice, the KNL project founders started to develop their

own platform in order to support agricultural producers. We offer a transparent accreditation procedure,

loaning, trading for farmers and storing of the collateral crop volumes either at our own elevators or the

partner‘s ones.

The KNL platform is a new economic model built on the blockchain, providing tools for individual

investors,small, medium and large businesses.

The platform allows you to combine managers / owners of assets and investors through new financial

instruments that reduce the level of risk of operations. Assets can be items in real estate, agriculture,

manufacturing,sharesin the enterprise and others.

We are creating an infrastructure based on a legislative framework to maximize the safety and security

of investments on the KNL platform. Kernel-Trade is based on the Stellar network “Token D” core and uses

advanced blockchain technologies, such as fast processing of transactions with minimal cost, high security

processes – fromrelease / storage to transfer tokensfor trading in the secondarymarket.

Key tasks of KNL platform

- Digitization of bureaucratic processes based on our own Blockchain, that is adapted to the specific

features of transactions in the agricultural industry. It will give you an opportunity to fast and reliable

lock in the conditions of each transaction between farmers and investors.

- Tokenization of raw material assets is implemented through the integration of our own digitalized

elevators’ network with a partner network. For example, a farmer's crops may be kept in KNL elevators

and act as a transaction security. At the same time, a tokenized asset (crop) can be engaged in

transactions on our own Kernel-Trade stock exchange.

- Logistic processes support, starting from the crop yield transportation from the field to the elevator,

ending with direct delivery of crops to the buyer when using deliverable contracts on the Kernel - Trade

exchange.

- The development of our own cross-border payment network will be performed with the help of tokenized

assets. This will allow to carry out financial coverage of export operations, deliverable and nondeliverable contracts on the Kernel-Trade exchange online, with a transaction speed of 1-3 seconds,

instead of 3-10 banking days. The KNL transaction token will be the equivalent of securities supported

by raw materials that are stored in our own elevators and elevators of accredited partners.

- Our own mechanismof insurance of the investmentsin the future harvest or construction, excluding the

loss of fundsfor the investor.

APPLICATION OF OUR OWN BLOCKCHAIN

In order to provide its operational activities, KNL ecosystem uses 2 ETH - based tokens and transactional KNL

token with its own Stellar - based Blockchain.

At the project’slaunch stage in October 2018, we chose a strategy of attracting investments byselling the VEXEL

tokens within the framework of closed rounds with the profitability payment. After the decision on conducting IEO was

made, we issued a new ETH token that will be traded on the exchange in 2019. Forming - up the platform key

transactional elements will be carried out with the help of Stellar technology as part of the development of our own

Blockchain.

The investment model with the use of ETH-token allowed in short time and with minimal expenses to complete

the major stage of fundraising in order to develop a revolutionary commodity exchange with a partner elevators’ network

and integrated with cross-border paymentsystem.

Such an approach is a classic one in the sphere of cryptocurrency investment. What’s more, we provide the

investors with additional guaranteed protection against investments loss through the specialized smart contracts

operating on the Ethereum network.

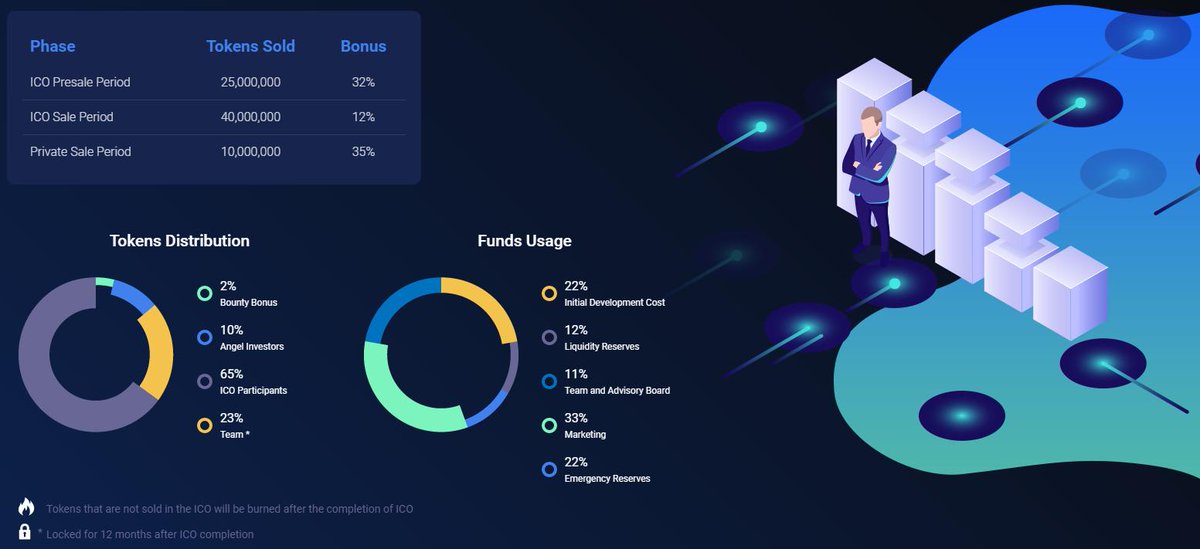

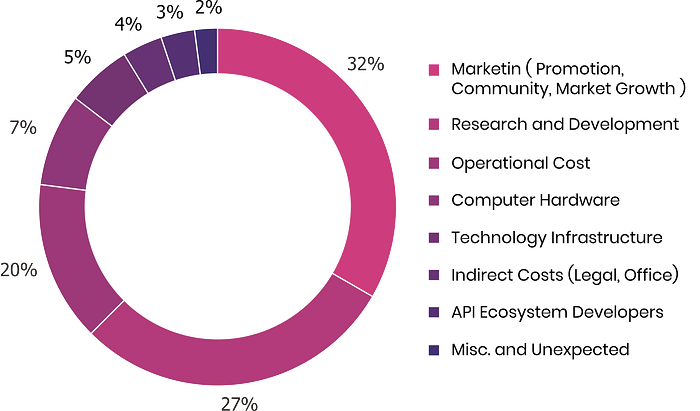

DISTRIBUTION OF FUNDS

6% | Operating expenses

10% | Legal Security

10% | Development of our own Stellar - based

Blockchain

25% | Marketing and advertising

49% | The exchange launch and issuance of the transactional

token KNL integrated with the KNL cross-border payment system

TOKEN DITRIBUTION

5% | Fund

5% | Advisers

10% | Bounty-program

20% | Team

60% | Realization within the IEO

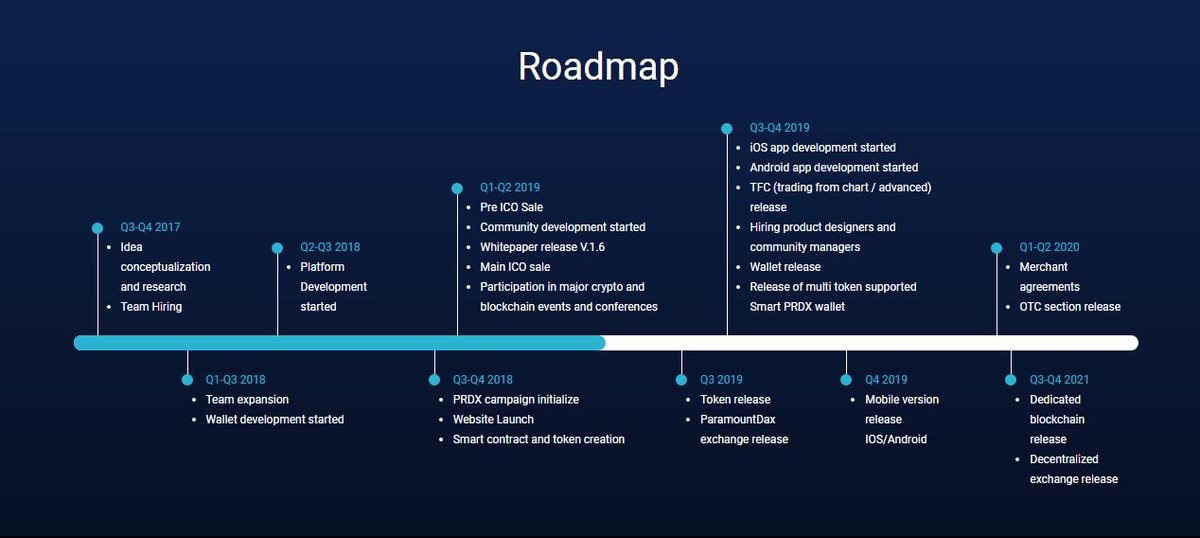

ROADMAP

- Q3-Q4 2018

Concept development, market analysis

and analysis of problems connected to

the loaning of farmers, team building,

platform scheme development, Business

Plan creation, provisional transaction

approval for the first elevator purchase

and partial payment

- Q1 2019

Official site launch, work on platform

modules that include a digital asset

exchange, company incorporation,

negotiations with potential advisors,

development of the company’s legal

papers and a smart token contract, work

on the web interface’s first version,

marketing campaign planning

- Q2 2019

Pre-IEO start with bonuses, preparation

of the crowdfunding platform modules’

launching and digital asset exchange,

finalizing of the agreements with

cryptocurrency exchanges, partner

network creation

- Q3 2019

IEO realizing and listing on several

exchanges, launching of digital assets

and crowdfunding platforms, receiving

licenses for exchange operations with

cryptocurrency in Estonia, project

presentation to the private investors and

the investment pool creation, hiring of

additional team members and advisors,

attracting partners to the site, performing

the first investment transactions,

marketing campaign, company

presentation at several events in Russia

and the CIS, beginning of marketing

expansion in Europe and Asia,

Switzerland company office opening

- Q4 2019

Hong Kong company office opening,

receiving a license for exchange and

banking activities in the UK, payment of

the remaining sum for the first elevator

purchase, presentation of the project at

big agricultural exhibitions, international

advertising campaign, marketing

campaign in the CIS countries, purchase

of a second elevator, release of native

iOS and Android applications

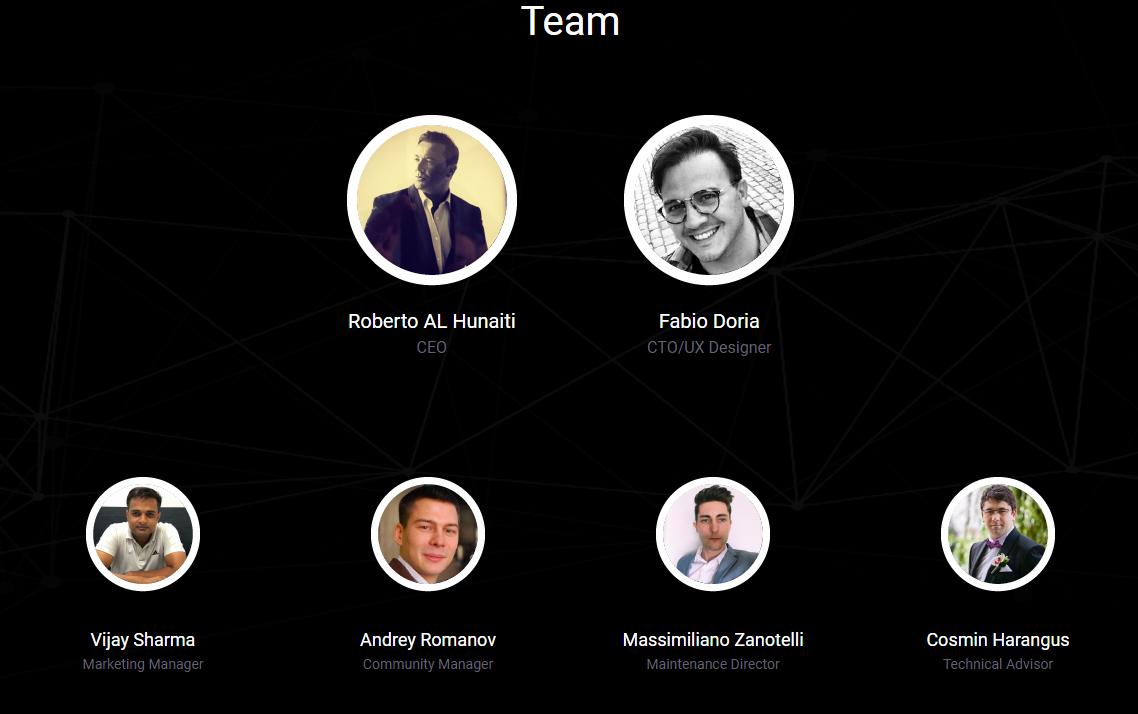

TEAM

Kolesnikov

Andrey Grigorievich - Director General of the KNL tokenization platform

development

Alhasov

Roman - Developer, marketer of KNL project

Raiskiy

Ilya - Specialist of the PR - unit of the KNL

tokenization platform

Minin

Denis - Leading KNL project marketer, SMM coordinator

Glazov

Andrey - Senior Marketing Research Analyst

Nesmashniy

Denis - KNL Token Platform Tester

INFORMATION

AUTHOR